Payroll does not fail because companies do not pay salaries. It fails because companies do not document salaries correctly.

That is exactly why a payslip generator has become a core operational tool rather than an optional HR utility.

Today, payslips are not only used for employee communication. Instead, they serve as legal records, compliance documents, audit evidence, and financial proof. Therefore, any mistake in a payslip can trigger disputes, tax issues, or even legal penalties.

In this complete guide, you will learn:

- What a payslip is and why it matters legally

- How a generator works

- The correct payslip format in India

- Each salary component explained in detail

- Common payroll mistakes and how to avoid them

- How to automate payslip generation for your business

- Why INDPayroll offers the most practical free generator

Let us start with the fundamentals.

What Is a Payslip and Why It Is Legally Important in India?

A payslip is an official salary statement issued by an employer to an employee. It shows exactly how the salary is calculated, what deductions are applied, and what amount is finally paid.

However, a payslip is far more than a salary receipt.

In India, a payslip is used for:

- Income proof for loans, visas, and credit cards

- tax filing and verification

- PF and ESI reconciliation

- Employment background checks

- Labor audits and inspections

- Salary dispute resolution

Therefore, when you use a payslip generator, you are not just generating a document. Instead, you are creating a compliance-grade financial record.

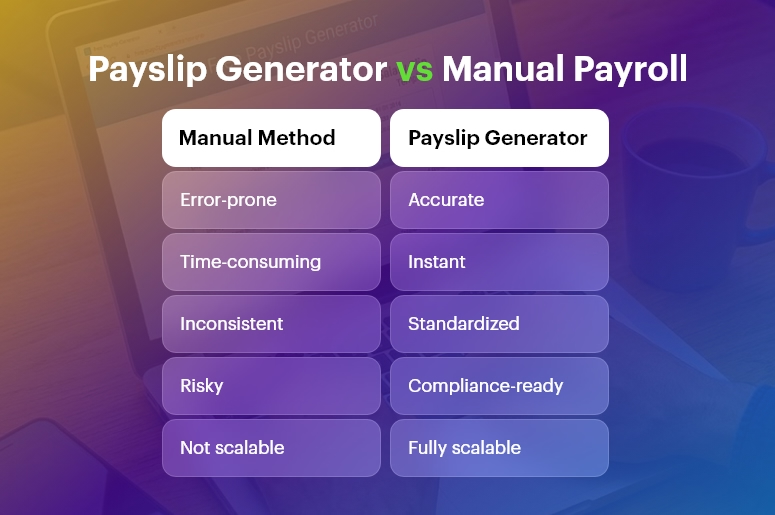

Why Manual Payslip Creation Is a Serious Business Risk

Many businesses still use Excel or Word to create payslips. Although this looks simple, it introduces multiple hidden risks:

- Formula and calculation errors

- Inconsistent salary structures

- Missing statutory fields

- Incorrect PF, ESI, or TDS deductions

- No version control or audit trail

As a result, companies face employee disputes, compliance notices, and operational inefficiencies.

This is precisely why a payslip app is not a convenience tool. It is a risk management tool.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

What Is a Payslip Generator?

A payslip generator is an online system that automatically:

- Calculates salary components

- Applies statutory deductions

- Structures payslip format

- Generates professional payslips

- Produces downloadable PDFs

Instead of manually working with formulas and formats, you simply input the salary details and let the payslip generator handle the rest.

Key Benefits of Using a Payslip Generator

When businesses shift to a payslip generator, they immediately gain:

- Faster payroll processing

- Zero calculation errors

- Consistent salary structure

- Built-in compliance readiness

- Better employee trust

- Lower HR workload

In addition, a payslip app makes payroll scalable without increasing administrative cost.

Free Payroll, PF, ESI & TDS Software

Standard Payslip Format in India (Fully Explained)

Every compliant Indian payslip contains four core sections.

1. Employee & Employer Details

This section establishes the identity and legal ownership of the salary record.

Employee Details include:

- First get Employee name and ID for unique identification

- Designation and department for role-based classification

- PAN for income tax reporting and TDS reconciliation

- UAN for PF tracking and statutory linkage

Employer Details include:

- Company name and address for legal validity

- Pay period (month and year) for accounting relevance

A professional payslip generator auto-populates and standardizes this information to avoid inconsistencies.

2. Earnings Section (How Salary Is Built)

This section shows exactly how the salary is structured.

Common components include:

- Basic Salary: This is the foundation of the salary structure. PF, gratuity, and bonus calculations usually depend on it.

- House Rent Allowance (HRA): This component enables tax exemptions for employees who live in rented houses.

- Special Allowance: This is a balancing component used to adjust CTC structures without disturbing statutory ratios.

- Conveyance or Other Allowances: These may include transport, medical, communication, or location-based allowances.

A modern payslip generator ensures that:

- Every component is listed

- Totals are calculated correctly

- No earnings element is missed

3. Deductions Section (Where the Money Goes)

This section is the most compliance-sensitive part of the payslip.

Common deductions include:

- Provident Fund (PF): A mandatory retirement contribution based on Basic Salary.

- Employee State Insurance (ESI): A social security deduction for employees under the wage threshold.

- TDS (Tax Deducted at Source): Monthly income tax deduction based on projected annual income and tax regime.

- Professional Tax: State-level tax applicable in many regions.

- Other Recoveries: Such as salary advances or loan deductions.

A reliable payslip app calculates, applies, and displays all deductions accurately.

4. Net Pay (Take-Home Salary)

This section clearly shows:

Net Salary = Total Earnings – Total Deductions

This is the actual amount paid to the employee.

How to Generate Payslips Online Using a Payslip Generator

Using INDPayroll’s free payslip generator is extremely simple:

- Enter company details

- Add employee information

- Input salary components

- Add deductions

- Click generate

- Download or share the payslip

No Excel. No formulas. No formatting issues.

Common Payslip Mistakes That Cause Payroll Disputes

Even small mistakes can cause serious problems:

- Wrong PF or ESI calculation

- Incorrect TDS deduction

- Missing allowances

- Inconsistent payslip format

- Mismatch with offer letter

- Wrong employee identifiers

A payslip app eliminates these risks through automation and standardization.

Why Payslip Accuracy Is Critical for Compliance

Payslips directly affect:

- PF filings

- ESI filings

- TDS returns

- Labor audits

- Legal disputes

Therefore, inaccurate payslips mean compliance exposure.

A payslip generator ensures that your payroll documentation remains inspection-ready at all times.

How Small Businesses Can Automate Payslips Easily

Even a 5-employee company benefits from automation.

With a payslip generator, small businesses can:

- Save hours every month

- Avoid compliance errors

- Maintain professional records

- Scale without hiring extra staff

Who Should Use a Payslip Generator?

- Startups

- SMEs

- Enterprises

- HR teams

- Accounting firms

- Payroll consultants

- Staffing agencies

If you pay salaries, you need a payslip generator.

Why Choose INDPayroll’s Free Payslip Generator?

INDPayroll’s payslip generator is built specifically for Indian payroll:

- India-compliant salary format

- PF, ESI, and TDS ready

- Clean professional layout

- Free to use

- Instant PDF generation

- Upgrade path to full payroll automation

Final Thoughts: Payslip Generator Is No Longer Optional

In modern businesses, payroll is not an administrative task. It is a governance function.

A payslip generator ensures:

- Accuracy

- Compliance

- Trust

- Professionalism

If you still rely on manual methods, you are taking unnecessary risk.

Start using a payslip generator today and bring structure, control, and confidence into your payroll operations.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.