In India, payroll errors remain one of the top three causes of compliance penalties for small and mid-sized businesses.

Despite growing digitization, many organizations still rely on spreadsheets and outdated rules to design their salary structure in India — leading to tax inefficiencies, PF/ESI miscalculations, and employee dissatisfaction.

As we move into 2025, the complexity has only increased. Regulatory updates, evolving tax regimes, and a more informed workforce mean that salary design is no longer just an HR activity — it is a strategic finance decision.

This guide breaks down the salary structure in India in a clear, practical way. You will learn the core components, statutory deductions, and best practices to design compliant, tax-efficient, and scalable salary structures. More importantly, you will see how modern payroll automation helps businesses eliminate risk, reduce costs, and improve employee trust — without increasing operational effort.

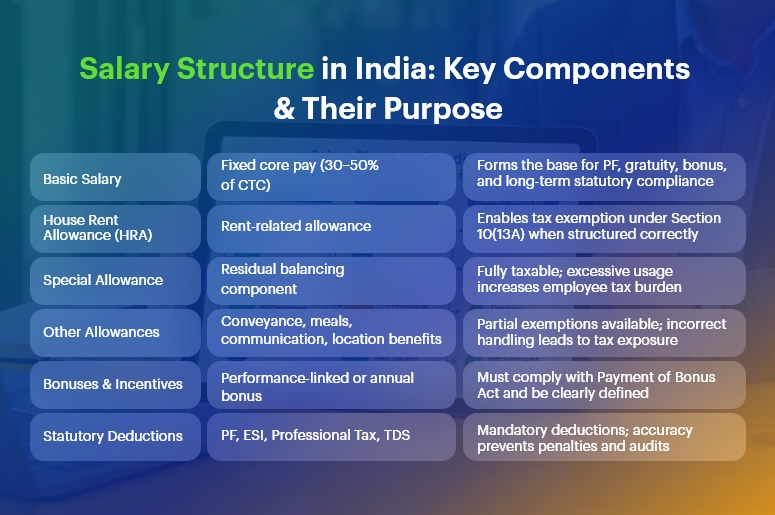

6 Key Components of Salary in India

- Basic Salary: The foundation of the salary structure in India, usually 30–50% of CTC. It directly impacts PF, gratuity, bonus eligibility, and long-term statutory compliance.

- House Rent Allowance (HRA): A critical tax-saving component when structured under Section 10(13A). Correct HRA allocation significantly improves employee take-home pay.

- Special Allowance: A flexible component used to balance total CTC. Since it is fully taxable, excessive reliance increases overall tax liability.

- Other Allowances: Includes conveyance, meals, communication, and location-based benefits. Some exemptions apply, but improper handling leads to tax exposure.

- Bonuses & Incentives: Performance-linked pay that drives productivity and retention. Must comply with the Bonus Act and be clearly defined in payroll policies.

- Statutory Deductions: Mandatory deductions such as PF, ESI, Professional Tax, and TDS. Accurate calculation is essential to avoid penalties and ensure employee trust.

Business Need & Importance

A well-defined salary structure in India directly impacts compliance, profitability, and employee retention. However, many businesses underestimate its importance until penalties or audits occur.

Why this matters today

- Rising compliance risk: PF, ESI, Professional Tax, and TDS rules require precise calculations. Even small errors compound monthly and attract penalties, interest, and scrutiny.

- Cost leakage: Poor salary structuring increases employer contributions unnecessarily, inflates CTC, and reduces take-home pay—hurting both margins and morale.

- Talent expectations: Employees today understand payslips. A confusing or unfair salary structure leads to mistrust and attrition.

Industry examples

- Manufacturing: Incorrect wage bifurcation inflates PF liability and impacts cost per unit.

- Retail & distribution: High attrition makes inconsistent salary structures difficult to manage at scale.

- Services & IT: Flexible pay, allowances, and tax planning are essential to remain competitive.

Why spreadsheets fail

Spreadsheets cannot dynamically apply statutory limits, auto-update compliance rules, or generate audit-ready reports.

As businesses grow, disconnected tools increase errors and slow payroll cycles. Therefore, automation is no longer optional — it is foundational.

Free Payroll, PF, ESI & TDS Software

Salary Structure in India: Components Explained

Core Salary Components

- Basic Salary: The foundation of the salary structure in India, usually 30–50% of CTC. PF and gratuity calculations depend heavily on basic salary, making it a critical compliance element.

- House Rent Allowance (HRA): Tax-exempt partially under Section 10(13A), provided rent receipts and conditions are met. Structuring HRA correctly significantly improves take-home pay.

- Special Allowance: A flexible component used to balance CTC. However, it is fully taxable and must be used strategically to avoid unnecessary tax burden.

- Conveyance & Other Allowances: Includes transport, communication, or meal allowances. While some exemptions exist, improper handling leads to tax exposure.

- Bonuses & Incentives: Performance-linked components improve motivation but must align with Bonus Act provisions where applicable.

Statutory Deductions

- Provident Fund (PF): Typically 12% of basic salary for both employer and employee. PF compliance is non-negotiable and closely audited.

- Employee State Insurance (ESI): Applicable for eligible employees under wage thresholds, covering medical and social security benefits.

- Professional Tax: State-specific deduction with monthly or annual caps.

- Income Tax (TDS): Calculated based on the chosen tax regime and declared investments.

Best Practices, Frameworks & Actionable Tips

Best Practices for Salary Structure in India

- Keep basic salary balanced: A very high basic increases PF costs, while too low raises compliance red flags. Maintain industry-aligned ratios.

- Optimize tax-exempt components: Proper use of HRA and allowances improves employee satisfaction without increasing CTC.

- Standardize across roles: Role-based templates reduce inconsistencies and simplify audits.

- Automate statutory calculations: Automation ensures real-time compliance with PF, ESI, PT, and TDS rules.

Do’s and Don’ts

- Do align salary structures with labor laws and audit expectations.

- Do not design salaries purely to reduce tax at the cost of compliance.

- Do revisit structures annually due to regulatory changes.

- Do not rely on manual overrides or ad-hoc adjustments.

Common Mistakes to Avoid

- Incorrect PF applicability on allowances

- Ignoring state-specific professional tax rules

- Mixing reimbursements with allowances

- Failing to document salary policies

Customer Success Example

For example, a mid-sized manufacturing business struggled with inconsistent salary structures across plants. PF calculations varied by location, causing frequent notices and delayed payroll closures.

They implemented automated salary structuring and compliance workflows using INDPayroll. Within three months, they achieved 100% statutory accuracy, reduced payroll processing time by 40%, and eliminated manual reconciliation. Employee queries dropped significantly due to clearer payslips and transparent deductions.

This transformation allowed the finance team to focus on cost optimization instead of firefighting compliance issues.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

Key Takeaways & Closing

A compliant, transparent, and optimized salary structure in India is no longer optional — it is a competitive necessity. Businesses that invest in structured payroll processes reduce risk, improve employee trust, and gain financial clarity.

As regulations evolve and workforces grow, the future belongs to organizations that automate intelligently and design salary structures with both compliance and people in mind.

FAQs

1. What is the ideal salary structure in India for SMBs?

An ideal salary structure in India balances basic pay, allowances, and compliance deductions while optimizing tax efficiency and take-home salary.

2. Is basic salary mandatory in salary structure in India?

Yes. Basic salary is a mandatory component and forms the base for PF, gratuity, and other statutory calculations.

3. How does salary structure in India impact tax savings?

A well-designed salary structure in India uses HRA and exemptions to legally reduce taxable income.

4. Can salary structure in India differ by role or department?

Yes. Role-based structures are allowed, provided compliance rules remain consistent and documented.

5. How often should businesses review salary structure in India?

At least once a year or whenever tax laws, wage limits, or business scale changes.

6. Can payroll software manage salary structure automatically?

Modern systems like INDPayroll automatically apply rules, calculate deductions, and update compliance for salary structure in India.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.