Payroll in India is a complex function because employers must handle salaries, variable pay, attendance, leave rules, deductions, and constantly changing statutory norms every single month. For SMEs running on smaller HR teams and tighter budgets, managing payroll manually is not just difficult — it is risky.

Indian SMEs often face:

- Spreadsheets overloaded with data

- Common miscalculations creating salary disputes

- Outdated compliance knowledge causing penalties

- Manual attendance reconciliation taking days

- Slow and error-prone report generation for audits

- Increased HR effort with zero strategic output

One mismanaged payroll cycle can damage employee trust and brand reputation.

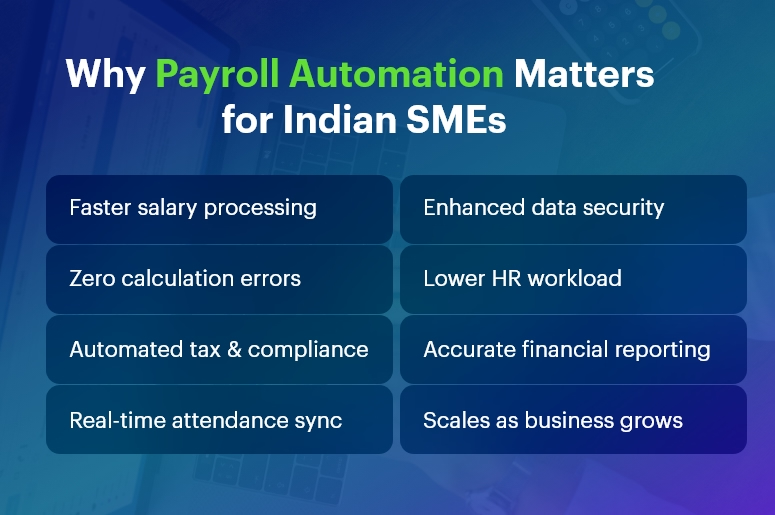

This is why many SMEs in India are turning to Payroll Automation — a smarter, more secure, and highly efficient way to manage payroll. Automation uses technology to calculate salaries, apply statutory rules, process attendance, generate reports, and ensure compliance — with minimal human intervention.

Below is an in-depth, professional, and extensively detailed breakdown of how Payroll Automation transforms Indian businesses.

Top 15 Payroll Automation Benefits for SMEs in India

Faster Salary Processing Means Happier Employees

Indian SMEs often spend 3–7 days every month preparing payroll manually. Automation cuts this time by more than 70%, because:

- Salary structures are pre-configured

- Attendance updates automatically

- Deductions are applied instantly

- No need to repeat data entry every month

Employees receive salaries on time — which directly improves morale, retention, and trust. In today’s competitive job market, timely salary payments can be a big differentiator.

Highly Accurate Calculations Reduce Payroll Disputes

Manual payroll often results in:

- Incorrect salaries

- Wrong overtime payouts

- Missing allowances

- Wrong TDS deductions

These mistakes are frustrating for employees and expensive for SMEs. Automation ensures accurate salary breakdowns using predefined formulas, so math errors are eliminated and employee satisfaction increases.

Seamless Statutory Compliance for Indian Labor Laws

Compliance is one of the biggest challenges for Indian SMEs. Payroll Automation always follows:

- Latest PF, ESI calculation rules

- Updated TDS slabs & exemptions

- State-wise Professional Tax differences

- Bonus, Gratuity & Minimum Wages rules

- Labor Welfare Fund contributions

The system updates automatically with every policy change. This protects SMEs from:

- Penalties

- Legal issues

- Audit failures

Businesses stay peacefully compliant.

Real-Time Attendance & Shift Management That Syncs Automatically

When Human Resources manually reconciles attendance from punch cards, emails, or Excel sheets, errors are guaranteed.

Automated payroll integrates with:

- Biometric devices

- Mobile GPS punch-in

- Web attendance portals

- Shift calendars

Every login, logout, leave, overtime hour is recorded in real time. Salary becomes 100% aligned with true productivity — no arguments later.

Full Transparency Through an Employee Self-Service Portal

An ESS portal empowers employees to:

- Download payslips instantly

- View salary summaries and tax calculations

- Track attendance and leave balances

- Claim and track reimbursements

- Update profile details

Employees feel informed and valued. HR saves countless hours answering repetitive salary queries.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

Significant Cost Savings — Immediate and Long Term

Payroll Automation reduces:

- Administrative workload

- Outsourced payroll expenses

- Compliance fines

- Paper, filing, and printing costs

SMEs operate more efficiently with the same HR team. Automation becomes a high-ROI investment — not an expense.

Ultra-Secure Protection for Payroll & Employee Data

Payroll touches the most confidential details of a business: Salaries, financials, bank information, PAN numbers, etc.

Automation offers:

- Data encryption

- Cloud backups

- Role-based access control

- Access logs & audit trails

This prevents leaks, misuse, or accidental data loss — something Excel can’t guarantee.

Instant Generation of Statutory and Payroll Reports

Preparing statutory forms manually (PF, ESI, TDS) is time-consuming and error-prone. With automation, files like:

- ECR files for PF portal

- TDS returns (Form 24Q/26Q)

- Salary registers

- Form 16 + MIS reports

are generated in seconds — accurate and ready for upload.

This reduces compliance stress and ensures filing happens before deadlines.

Productivity Boost for HR Teams

HR’s role is to develop people — not fight spreadsheets. Automation shifts HR’s energy to:

- Employee development

- Performance initiatives

- Recruitment & onboarding

- Workforce strategy

Organizations get better HR output without hiring more people.

Eliminates Fraud and Payroll Manipulation

Common fraud cases in SMEs include:

- Ghost employees

- Fake overtime claims

- Modified attendance entries

- Cash-based payout manipulation

Automation ensures every action is recorded. There is a complete audit trail — no room for hidden salary leaks.

Multi-State Payroll Handled with Ease

As SMEs open branches across India, payroll complexity increases due to state-specific:

- PT slabs

- Minimum wages

- Public holidays

- Employee categories

Automated payroll adapts for each location yet runs payroll centrally, saving tremendous regulatory effort.

Automated Digital Payslips — Professional and Paperless

Employees get legally compliant payslips:

- On their phones

- In the ESS portal

- Automatically via email

No printing, no waiting, no errors. Digital payslips also give companies a modern professional impression.

Automated Leave, Loan & Reimbursement Accounting

Every leave approval or salary advance automatically flows into payroll.

The system:

- Calculates LOP accurately

- Tracks EMI-based repayments

- Approves and verifies expense claims

This ensures zero disputes and complete visibility into financial adjustments.

Advanced Analytics for Better Financial Control

Owners and decision-makers get dashboards showing:

- Salary cost trends

- Overtime vs. productivity

- Department-wise payroll impact

- Budget deviation alerts

These insights help optimize hiring, scheduling, and compensation — fueling better profitability.

Easily Scalable As Your Business Grows

As SMEs expand:

- New employees

- New salary structures

- New branches

…can be added effortlessly.

Payroll stays equally efficient whether managing 10 or 10,000 employees. Automation ensures payroll never becomes a growth roadblock.

Free Payroll, PF, ESI & TDS Software

Final Thoughts

Payroll Automation is more than digitizing payroll —

- It transforms how SMEs operate.

- It builds employee trust and strengthens compliance.

- It enables leaders to focus on growth rather than paperwork.

In India’s fast-moving economy, companies that automate will advance. Companies that remain manual will fall behind.

Payroll Automation is the foundation of a future-ready SME.

Frequently Asked Questions

- Do small businesses really need payroll automation?

Yes. Even with 5–10 employees, automation improves transparency, efficiency, and compliance accuracy.

- Will payroll automation reduce HR workloads?

Absolutely. Mundane tasks disappear, allowing HR to focus on employee success and culture development.

- How does automated payroll ensure compliance?

It auto-updates tax laws and generates government-friendly files for PF, ESI, and TDS filings.

- Is automated payroll safe for sensitive employee data?

Yes. Encryption, backups, and permissions make it far more secure than spreadsheets.

- How long does implementation take for an SME?

Most businesses can go live in 1–7 days, depending on employee size and data format.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.