Payroll was never designed for today’s workforce. Contract professionals, gig workers, and remote employees now power modern businesses. However, most payroll processes still assume fixed salaries, single locations, and uniform tax rules. As a result, businesses struggle with errors, compliance gaps, delayed payments, and operational stress. This is exactly why organizations must simplify payroll.

In this comprehensive guide, you will learn how to simplify payroll for contract, gig, and remote employees using structured processes, automation, and a single purpose-built platform: INDPayroll, a 100% free payroll software designed for growing and distributed teams.

Why Payroll Gets Complicated for Contract, Gig & Remote Workers

Before you can simplify payroll, you must understand why it becomes complex in the first place.

Contract, gig, and remote work introduces:

- Multiple worker classifications

- Variable pay structures

- Location-based tax rules

- Inconsistent working hours

- Manual documentation overhead

Consequently, traditional payroll workflows break down. Teams spend more time fixing payroll issues than running payroll itself. Therefore, the first step to simplify payroll is removing manual complexity.

Step 1: Clearly Define Worker Categories

To simplify payroll, clarity comes first.

Every organization should explicitly define:

- Contract employees – paid per agreement, responsible for their own taxes

- Gig workers – task-based or milestone-based payments

- Remote employees – salaried or hourly staff working from different locations

When these worker types are mixed without structure, payroll errors increase. However, when worker categories are clearly mapped inside a payroll system like INDPayroll, payroll instantly becomes easier to manage.

Step 2: Centralize Payroll in One System

Fragmented tools create fragmented payroll.

To simplify payroll, you need a single system that:

- Manages multiple worker types

- Automates calculations

- Stores documentation

- Tracks payments and compliance

INDPayroll centralizes payroll for contract, gig, and remote employees into one unified platform. More importantly, INDPayroll is 100% free, eliminating the cost barrier that prevents many businesses from upgrading their payroll processes.

By moving payroll into one system, organizations immediately simplify payroll operations and reduce dependency on spreadsheets and manual calculations.

Step 3: Automate Payroll Calculations

Manual payroll calculations are the biggest source of errors.

To truly simplify payroll, automation is non-negotiable.

INDPayroll automates:

- Earnings calculations

- Deductions and statutory components

- Payment summaries

- Payroll reports

As a result, payroll teams spend less time reconciling numbers and more time ensuring accuracy. Automation also ensures consistency, which is essential when handling contract and gig payments.

Step 4: Maintain Compliance Without Manual Effort

Compliance is where payroll usually fails.

Different employment types come with different legal obligations. If these are not tracked properly, businesses risk penalties and disputes. Therefore, to simplify payroll, compliance must be built into the system.

INDPayroll supports:

- Structured payroll records

- Transparent payment history

- Audit-ready reports

- Clear classification of worker types

By embedding compliance into everyday payroll workflows, INDPayroll removes uncertainty and helps organizations simplify payroll without relying on external tools.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

Step 5: Standardize Payroll Schedules

Unclear pay schedules create confusion and distrust.

To simplify payroll, organizations should establish consistent payment cycles for each worker type:

- Monthly or biweekly payroll for remote employees

- Agreed invoice-based cycles for contractors

- Regular payout intervals for gig workers

INDPayroll allows businesses to manage these schedules within a single system. Consequently, payment delays reduce, disputes decline, and payroll communication becomes predictable.

Step 6: Simplify Documentation and Onboarding

Payroll does not start with payments. It starts with onboarding.

To simplify payroll, documentation must be standardized:

- Contracts

- Tax declarations

- Payment terms

- Bank details

INDPayroll enables centralized storage and access to payroll-related data. This ensures that payroll runs smoothly from day one and prevents repeated follow-ups for missing information.

Step 7: Gain Visibility Through Payroll Reporting

Visibility simplifies decision-making.

To simplify payroll, businesses must understand:

- Total payroll cost

- Payments by worker type

- Monthly and annual payroll trends

INDPayroll provides clear payroll reports that help teams monitor expenses, forecast costs, and identify discrepancies early. With real-time visibility, payroll shifts from reactive to controlled.

Common Payroll Mistakes That Prevent Simplification

Many organizations unintentionally make payroll harder than it needs to be.

Here are common mistakes that stop teams from being able to simplify payroll:

- Relying on spreadsheets

- Managing contractors outside payroll systems

- Manual tax calculations

- No centralized payroll records

- Paying for expensive payroll software unnecessarily

INDPayroll eliminates these issues by offering a 100% free, structured, and automated payroll platform.

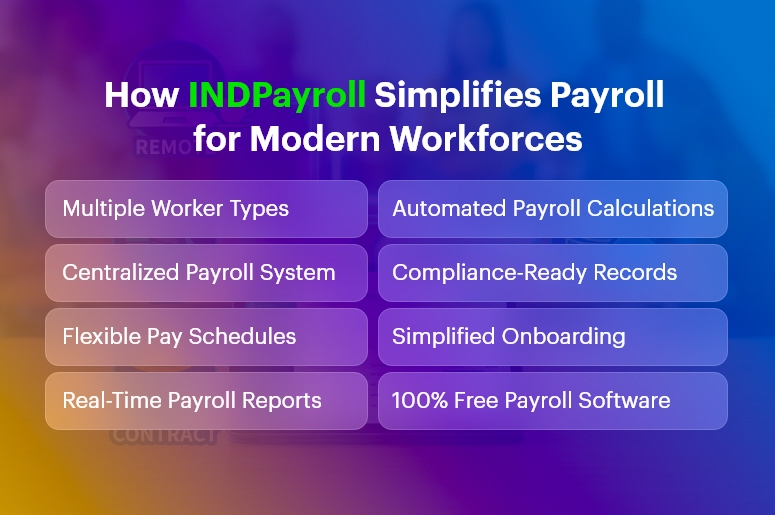

Why INDPayroll Is the Best Way to Simplify Payroll

When evaluating payroll solutions, simplicity, cost, and reliability matter most.

INDPayroll stands out because:

- It is 100% free payroll software

- It supports contract, gig, and remote employees

- It automates payroll calculations

- It centralizes payroll data

- It reduces compliance risk

- It scales with growing teams

Instead of managing payroll through fragmented tools, INDPayroll enables organizations to simplify payroll without increasing costs or complexity.

How Simplified Payroll Impacts Business Growth

Payroll efficiency directly affects growth.

When you simplify payroll:

- HR teams save time

- Finance teams reduce errors

- Workers receive timely payments

- Compliance risks decrease

- Leadership gains cost clarity

By removing friction from payroll, businesses can focus on expansion instead of administration.

Free Payroll, PF, ESI & TDS Software

Final Thoughts

Payroll complexity is not a workforce problem. It is a system problem. To simplify payroll for contract, gig, and remote employees, businesses must adopt automation, clarity, and centralized control. INDPayroll delivers all three — without cost.

If your organization wants to simplify payroll, reduce errors, and support modern workforces efficiently, INDPayroll provides the most practical and cost-effective solution available today. Simple. Compliant. Scalable. And 100% Free.

FAQs

1. How can businesses simplify payroll for contract, gig, and remote employees?

Businesses can simplify payroll by using a centralized payroll system that supports multiple worker types, automates calculations, maintains compliance records, and standardizes pay schedules. INDPayroll enables all of this in one platform.

2. What makes payroll for contract and gig workers more complex?

Contract and gig workers often have variable pay, different tax responsibilities, and flexible schedules. Without automation and structured workflows, managing these differences manually leads to errors and delays.

3. Is INDPayroll suitable for both contract and remote employees?

Yes. INDPayroll is designed to manage payroll for contract workers, gig contributors, and remote employees within a single system, making it easier to handle diverse workforce models.

4. Is INDPayroll really 100% free payroll software?

Yes. INDPayroll is a 100% free payroll software that allows businesses to manage payroll without subscription fees or hidden costs.

5. How does INDPayroll help maintain payroll compliance?

INDPayroll helps maintain compliance by organizing payroll records, supporting clear worker classification, generating audit-ready reports, and ensuring consistent payroll documentation.

6. Can INDPayroll handle different payroll schedules?

Yes. INDPayroll allows businesses to manage multiple payroll schedules, making it easy to pay remote employees, contractors, and gig workers according to agreed timelines.

7. Does INDPayroll reduce payroll errors?

Yes. By automating payroll calculations and eliminating manual data entry, INDPayroll significantly reduces errors related to payments, deductions, and reporting.

8. How does INDPayroll help HR and finance teams save time?

INDPayroll streamlines payroll workflows, centralizes employee data, and automates repetitive tasks, allowing HR and finance teams to focus on strategic activities instead of payroll administration.

9. Can growing businesses scale payroll using INDPayroll?

Yes. INDPayroll is built to scale as businesses grow, supporting increasing headcount, multiple worker types, and higher payroll volumes without additional software costs.

10. Why should businesses choose INDPayroll over manual payroll methods?

Manual payroll methods increase errors, compliance risks, and administrative workload. INDPayroll simplifies payroll management, improves accuracy, and delivers these benefits as a 100% free payroll software.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.