Payroll should be simple. Yet for many Indian businesses, it remains one of the most stressful, error-prone, and expensive monthly operations.

In fact, a large percentage of payroll errors in India originate from manual calculations, outdated spreadsheets, or disconnected systems — leading to penalties, employee dissatisfaction, and compliance risks.

As we move into 2026, businesses face increasing regulatory complexity, rising operational costs, and growing employee expectations.

At the same time, small and mid-sized businesses are under pressure to operate leaner, faster, and smarter.

This raises a critical question: Is it really possible to run payroll in India without any cost — and still stay compliant?

The answer is yes.

In this comprehensive guide, you will learn exactly how to run payroll in India without any cost, using modern automation, free payroll platforms, and best practices trusted by growing businesses.

More importantly, you will understand how solutions like INDPayroll help businesses eliminate payroll expenses while improving accuracy, compliance, and operational efficiency.

Why Running Payroll Without Cost Matters More Than Ever

In today’s business environment, payroll is no longer just an HR task. It directly impacts cash flow, compliance, employee trust, and leadership credibility.

Rising Payroll Challenges Across Industries

Manufacturing companies often struggle with shift-based attendance, overtime calculations, and statutory compliance. Retail and distribution businesses face high employee turnover, variable pay structures, and frequent onboarding. Meanwhile, service-based companies and startups deal with multi-location teams, contractors, and tight budgets.

Across industries, businesses face common payroll challenges:

-

Manual payroll processing increases errors and rework

When payroll depends on spreadsheets and manual formulas, even a small change in attendance, tax rules, or salary structure can create cascading errors. These mistakes consume hours of correction time and increase compliance risk.

-

High payroll software costs strain growing businesses

Many payroll tools charge per employee or per month, making them expensive as teams scale. For SMBs and startups, these recurring costs quickly add up without delivering proportional value.

-

Disconnected systems reduce visibility and control

Payroll systems that do not integrate with attendance, HR, finance, or compliance workflows create data silos. As a result, teams spend more time reconciling data than making informed decisions.

Why Spreadsheets Are No Longer Enough

Spreadsheets may appear “free” but they carry hidden costs — manual effort, compliance risk, delayed processing, and employee dissatisfaction. In 2025, growing businesses need automated, connected, and compliant payroll systems that scale without increasing cost.

This is precisely why more businesses are choosing to run payroll in India without any cost using modern platforms like INDPayroll, instead of outdated tools.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.

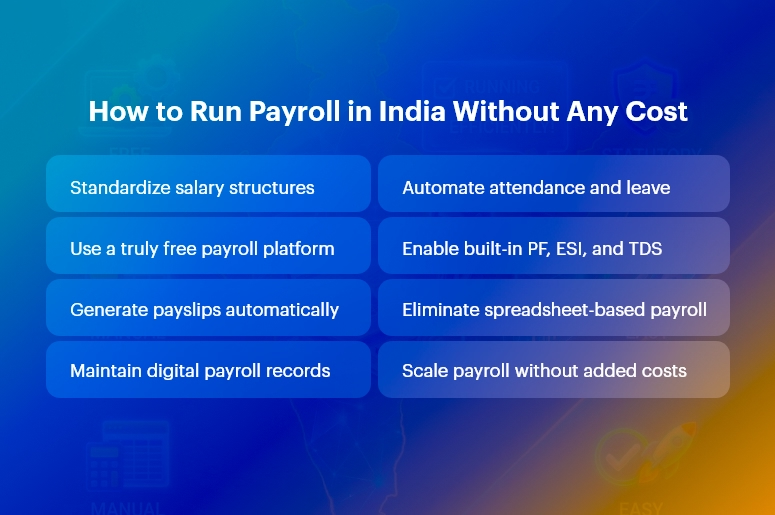

Best Practices, Frameworks & Actionable Tips to Run Payroll in India Without Any Cost

Running payroll for free is not about cutting corners. It is about working smarter, not harder. Below is a proven framework followed by successful Indian businesses.

Step 1: Standardize Your Payroll Structure

A clear payroll structure is the foundation of cost-free payroll.

- Define salary components clearly and consistently: Break salaries into basic pay, allowances, deductions, and statutory contributions. A standardized structure reduces manual adjustments and simplifies automation across teams.

- Align salary components with statutory rules: PF, ESI, and TDS calculations depend on correct component mapping. When aligned properly, automation tools like INDPayroll calculate deductions accurately without manual intervention.

Step 2: Automate Attendance and Leave Tracking

Payroll errors often originate from inaccurate attendance data.

- Centralize attendance and leave data: Use a system that automatically feeds attendance, overtime, and leave data into payroll. This eliminates duplicate data entry and reduces payroll delays.

- Avoid manual attendance reconciliation: Manual attendance tracking creates inconsistencies that affect salary accuracy. Automation ensures payroll always reflects real working hours.

INDPayroll integrates attendance and payroll seamlessly, ensuring accurate salary processing at zero cost.

Step 3: Use a Truly Free Payroll Platform

Not all “free” payroll tools are truly free.

- Choose a platform with no hidden fees: Many tools advertise free trials but later charge for essentials like payslips or compliance reports. INDPayroll offers 100% free payroll processing without usage caps.

- Ensure statutory compliance is built-in: A free payroll system must support PF, ESI, TDS, and payslip generation automatically. This eliminates dependency on external consultants.

Step 4: Follow Payroll Do’s and Don’ts

Do’s

- Automate calculations wherever possible to eliminate errors and save time.

- Review payroll summaries before finalization to catch anomalies early.

- Maintain digital records for audits and statutory filings.

Don’ts

- Do not rely on manual spreadsheets as your primary payroll system.

- Do not delay payroll processing, as it impacts employee trust.

- Do not ignore compliance updates, which can lead to penalties.

Step 5: Leverage INDPayroll as an End-to-End Solution

INDPayroll goes beyond payroll. It connects HRMS, Payroll, Finance, Projects, Manufacturing, Inventory, and CRM into a unified platform. This ensures payroll data flows seamlessly across departments, enabling smarter decisions and operational efficiency — without increasing cost.

Customer Success

For example, Sharma Precision Components, a mid-sized manufacturing business, struggled with payroll errors, overtime disputes, and high payroll software costs. They implemented automated payroll and attendance management using INDPayroll to address these challenges.

Within 60 days, they achieved:

- 70% reduction in payroll processing time

- 100% accuracy in PF and ESI calculations

- Zero payroll software expenses

- Faster salary closures and improved employee satisfaction

By switching to INDPayroll, Sharma Precision transformed payroll from a monthly headache into a streamlined, cost-free operation that supported business growth.

Free Payroll, PF, ESI & TDS Software

Key Takeaways & Closing

Running payroll does not have to be expensive, complex, or stressful. With the right approach, businesses can run payroll in India without any cost while maintaining accuracy, compliance, and employee trust.

By standardizing payroll structures, automating attendance, and using a free, integrated platform like INDPayroll, businesses eliminate hidden costs and future-proof their operations. As regulations evolve and teams grow, automation becomes not just an advantage — but a necessity.

The future of payroll is connected, compliant, and cost-free.

FAQs

1. Is it really possible to run payroll in India without any cost?

Yes, businesses can run payroll in India without any cost by using free payroll platforms like INDPayroll that automate salary, compliance, and payslips without subscription fees.

2. Are free payroll systems compliant with Indian laws?

A reliable free payroll system includes built-in compliance for PF, ESI, TDS, and payslips. INDPayroll ensures statutory compliance while remaining cost-free.

3. Can small businesses trust free payroll software?

Yes, many SMBs successfully use free payroll tools. The key is choosing a platform with automation, security, and compliance, such as INDPayroll.

4. Does free payroll software support growing teams?

Modern free payroll platforms are designed to scale. INDPayroll supports growing teams without increasing payroll costs.

5. What are the risks of using spreadsheets for payroll?

Spreadsheets increase error risk, consume time, and lack compliance automation. Businesses aiming to run payroll in India without any cost should avoid spreadsheets.

6. How long does it take to implement INDPayroll?

Most businesses can set up and run payroll using INDPayroll within a few hours, making it a fast and cost-free transition.

7. Can INDPayroll integrate with other business systems?

Yes, INDPayroll integrates payroll with HRMS, finance, projects, manufacturing, inventory, and CRM for end-to-end operational visibility.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.