Managing payroll in India is complex. From ever-changing tax rules to labor regulations across multiple states, HR and finance teams spend countless hours ensuring payroll accuracy and compliance. That’s why choosing the right payroll software is crucial for Indian organizations—whether it’s a startup scaling fast or a large enterprise with distributed teams.

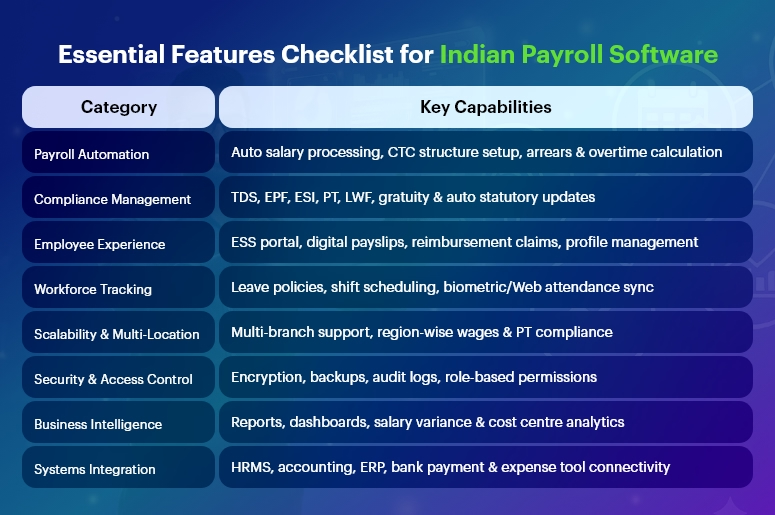

To help you make a confident decision, here are the Top 10 Features Every Indian Payroll Software Must Have to simplify payroll processing, ensure legal compliance, and improve employee experience.

Automated Payroll Processing & Salary Calculations

Manual payroll calculations often lead to errors, late salary payments, and employee dissatisfaction. A modern payroll solution must offer:

- Auto-calculation based on attendance data

- Support for multiple pay cycles (monthly/weekly)

- Automatic arrears, incentives, bonuses & overtime

- Configurable salary structures (CTC breakup)

With automation, companies reduce repetitive work and ensure 100% accuracy every month.

Compliance With Indian Statutory Laws

Payroll compliance in India is dynamic and varies across states. A reliable payroll software must ensure seamless compliance with:

- Income Tax / TDS

- EPF, ESI & Labour Welfare Fund (LWF)

- Professional Tax (PT)

- Gratuity & Bonus Act

- Minimum Wages Act

- Maternity Benefit Act

- Shops & Establishment Act regulations

It must auto-calculate contributions, generate challans, and update rules automatically to avoid penalties.

TDS, Income Tax & Investment Declarations Management

Employees should easily declare their investments for tax-saving purposes. Good payroll software should provide:

- Automatic tax projections on salary slips

- Section 80C & 80D declaration support

- Proof submission tracking

- Form 16 auto-generation

This simplifies the financial year-end chaos.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.

Employee Self-Service (ESS) Portal

A self-service portal transforms employee experience by providing access to:

- Digital payslips

- Tax documents (Form 16, salary certificates)

- Leave & attendance records

- Personal information updates

- Reimbursement claims

HR teams save significant time while employees stay empowered.

Leave & Attendance System Integration

Payroll and attendance must go hand-in-hand. A fully integrated system helps:

- Sync biometric or web attendance in real-time

- Auto-deduct leave without pay (LWP)

- Manage multiple leave types and policies

- Track shift schedules & overtime

This ensures accurate payouts every time.

Digital Reimbursements & Claims

Indian companies often offer tax-saving reimbursements like:

- Travel allowances

- Food coupons

- Phone/internet bill reimbursements

- Medical allowances

Payroll software should enable online claim submissions, approval workflows, and automatic payouts during payroll processing.

Multi-Location & Multi-State Support

Businesses expanding across states need payroll that supports:

- Region-specific PT, local rules & wages

- Multi-branch organization structure

- Centralized admin dashboard

- Multiple business units or legal entities

This ensures smooth processing for distributed workforces.

Secure Data Handling & Role-Based Access

Payroll data is highly sensitive. Security must be a top priority, including:

- End-to-end encryption

- Audit logs and detailed access permissions

- Cloud-based data backups

- ISO-compliant infrastructure

Role-based access ensures only authorized personnel can view salaries.

Comprehensive Payroll Reports & Analytics

Leadership needs insights for better decisions. The right software provides:

- Payroll registers & compliance reports

- Salary variance analysis

- Cost centre-wise breakdowns

- Reconciliation statements

Exportable reports (XLS, PDF) support audits and financial planning.

Integration With HR, Accounting & ERP Tools

Seamless integration eliminates duplicate data entry. Look for payroll that connects with:

- HRMS, timesheet & attendance software

- Bank payment systems for salary disbursement

- Corporate expense management tools

This builds a connected digital workforce ecosystem.

Free Payroll, PF, ESI & TDS Software

Final Thoughts

Indian payroll processing is unlike anywhere else in the world—and the right payroll software must solve challenges around regulatory compliance, multi-state management, and employee expectations.

Organizations should choose a solution that:

- Is future-ready and scalable

- Enables automation and compliance

- Improves employee experience

- Reduces manual workload for HR & finance

With the right digital payroll tool in place, companies can focus more on people and growth—and less on paperwork.

Frequently Asked Questions (FAQs)

1. What is the most important feature in Indian payroll software?

Automated statutory compliance and accurate salary calculations are the most crucial features to avoid legal issues.

2. Can payroll software handle multi-state compliance in India?

Yes, advanced solutions automatically apply state-specific rules like PT, minimum wages, and LWF.

3. Why do companies prefer cloud-based payroll?

Cloud payroll ensures security, accessibility, scalability, and real-time updates—especially for hybrid and remote teams.

4. Is payroll software useful for startups?

Absolutely! It minimizes HR workload, prevents calculation errors, and ensures compliance right from day one.

5. Can employees access payslips digitally?

Yes, through an ESS portal or mobile app, employees can download payslips anytime.

6. Does payroll software generate Form 16?

Yes, many solutions auto-generate and distribute Form 16 during tax season.

7. Is Tally integration available in Indian payroll software?

Most payroll systems offer accounting integration with Tally and ERP tools.

8. How does payroll software help in audits?

It provides standardized, exportable reports, reducing audit preparation time.

9. Can payroll software automate bank salary disbursements?

Yes, integration with bank systems enables hassle-free salary transfers.

10. What about data security in payroll software?

Modern platforms include encryption, access controls, and regular backups to secure sensitive payroll details.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.