Payroll should be predictable. Yet, for many Indian SMBs, it remains one of the most time-consuming and error-prone monthly activities.

Industry research shows that a majority of payroll discrepancies originate from manual calculations, spreadsheet dependency, and disconnected HR systems — leading to penalties, rework, and employee dissatisfaction.

In 2025, compliance complexity is rising while teams are expected to do more with fewer resources. Therefore, businesses need tools that run payroll in minutes, not days. This is no longer a convenience; it is a competitive necessity.

In this walkthrough, you will learn how to run payroll in minutes using INDPayroll — from employee setup to salary processing, statutory deductions, payslips, and reporting. We will also cover best practices, common mistakes, and a real-world success example to help you move from manual chaos to automated clarity.

Business Need & Importance

As businesses scale, payroll complexity increases exponentially. Headcount grows, pay structures diversify, and compliance obligations multiply. Consequently, spreadsheet-driven payroll cannot keep up.

Why this is a board-level concern today:

- Operational inefficiency: Manual payroll consumes HR and finance bandwidth every month. Additionally, approvals and corrections delay salary disbursement.

- Compliance risk: Errors in PF, ESI, TDS, and statutory filings expose businesses to penalties and audits.

- Employee trust erosion: Late or inaccurate payslips reduce morale and increase attrition.

- Cost leakage: Rework, penalties, and external consultants add hidden costs.

Industry examples:

- Manufacturing: Shift allowances, overtime, and contract labor make payroll calculations complex and error-prone.

- Retail & Distribution: High attrition and variable incentives require frequent payroll updates.

- Services & IT: Multiple pay components and compliance across locations demand automation.

Therefore, to run payroll in minutes, businesses must adopt digitized, integrated, and compliant payroll software that connects HR data, attendance, and finance — without manual intervention.

Step-by-Step Framework to Run Payroll in Minutes

Centralize employee data first

A single source of truth is essential. Store employee profiles, salary structures, bank details, and statutory IDs in one system. This eliminates duplication and ensures accuracy during processing.

Automate statutory calculations

Manual computation of PF, ESI, and TDS is risky. Automation ensures real-time accuracy aligned with current regulations, reducing compliance exposure.

Use payroll-ready attendance inputs

Integrate attendance, leaves, and holidays directly with payroll. Consequently, salary calculations reflect actual working days without manual adjustments.

Generate payslips and reports instantly

Automated payslips and statutory reports reduce processing time from hours to minutes while improving transparency.

Free Payroll, PF, ESI & TDS Software

The most trusted automation tool for modern Indian businesses.

Best Practices

- Standardize salary components: Clearly define earnings, deductions, and reimbursements. This prevents last-minute changes and ensures consistent calculations every cycle.

- Lock payroll periods: Freeze data before processing to avoid accidental edits. As a result, approvals become faster and more controlled.

- Audit before release: Run pre-payroll checks to validate totals, deductions, and net pay. This minimizes post-processing corrections.

Do’s and Don’ts

Do:

- Automate recurring payroll tasks to save time every month.

- Maintain compliance dashboards for PF, ESI, and TDS visibility.

- Train HR teams on system workflows to maximize adoption.

Don’t:

- Rely on spreadsheets as your primary payroll system.

- Delay compliance filings, which can attract penalties.

- Ignore payroll analytics, which provide cost and workforce insights.

Why INDPayroll Delivers an End-to-End Advantage

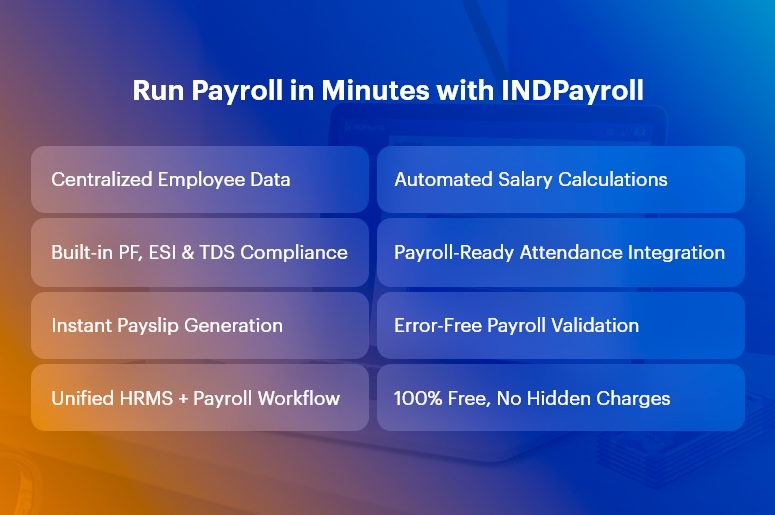

INDPayroll is designed to run payroll in minutes by connecting critical business modules:

- HRMS: Centralized employee and policy management.

- Payroll: Automated salary, deductions, payslips, and filings.

- Attendance & Leave: Real-time inputs for accurate payroll.

- Finance & Reporting: Salary cost visibility and compliance tracking.

Because everything operates within one ecosystem, businesses eliminate manual handoffs and accelerate payroll cycles.

Customer Success

For example, a mid-sized manufacturing company implemented automated payroll processing using INDPayroll to solve recurring salary delays and compliance errors. Within two payroll cycles, they reduced processing time by 70%, eliminated manual PF and ESI calculations, and achieved 100% on-time payslip distribution.

Moreover, HR teams reclaimed nearly 12 hours per month, which they redirected toward workforce planning and engagement initiatives. This transformation allowed Aarav Textiles to run payroll in minutes, even during peak production months.

Free Payroll, PF, ESI & TDS Software

Key Takeaways & Closing

Payroll efficiency directly impacts compliance, employee satisfaction, and operational agility. As regulations grow complex, businesses can no longer afford manual processes.

By adopting automation, standardization, and integrated workflows, organizations can run payroll in minutes with confidence.

INDPayroll empowers teams to move faster, reduce risk, and scale without adding administrative overhead. The future of payroll is not just digital — it is instant, accurate, and stress-free.

FAQs

1. Can small businesses really run payroll in minutes?

Yes. With automated calculations and centralized data, SMBs can run payroll in minutes without manual spreadsheets.

2. Is INDPayroll suitable for Indian compliance?

Absolutely. INDPayroll supports PF, ESI, TDS, and statutory reporting, ensuring compliance-ready payroll.

3. Does free payroll software compromise features?

No. INDPayroll offers full payroll functionality, allowing businesses to run payroll in minutes without hidden costs.

4. How long does implementation take?

Most teams complete setup within a few hours and process their first payroll the same day.

5. Can payroll integrate with HR and attendance?

Yes. INDPayroll integrates HRMS and attendance to ensure accurate salary calculations.

6. Is payroll data secure?

INDPayroll uses secure infrastructure and role-based access to protect sensitive payroll information.

Free Payroll, PF,

ESI & TDS Software

Professional compliance management for Indian businesses. 100% Free Forever.